GST (Goods and Services Tax), a landmark tax reform in India, was officially launched at midnight on June 30 – July 1, 2017, in New Delhi. Designed to streamline the indirect tax system, GST replaced multiple taxes such as VAT, service tax, and sales tax by bringing them under a single unified structure.

This reform has significantly improved India’s indirect taxation by eliminating the cascading effect of multiple taxes and enabling a seamless flow of input tax credit (ITC) for businesses. GST has also simplified tax compliance and boosted transparency and efficiency in tax collection across the country.

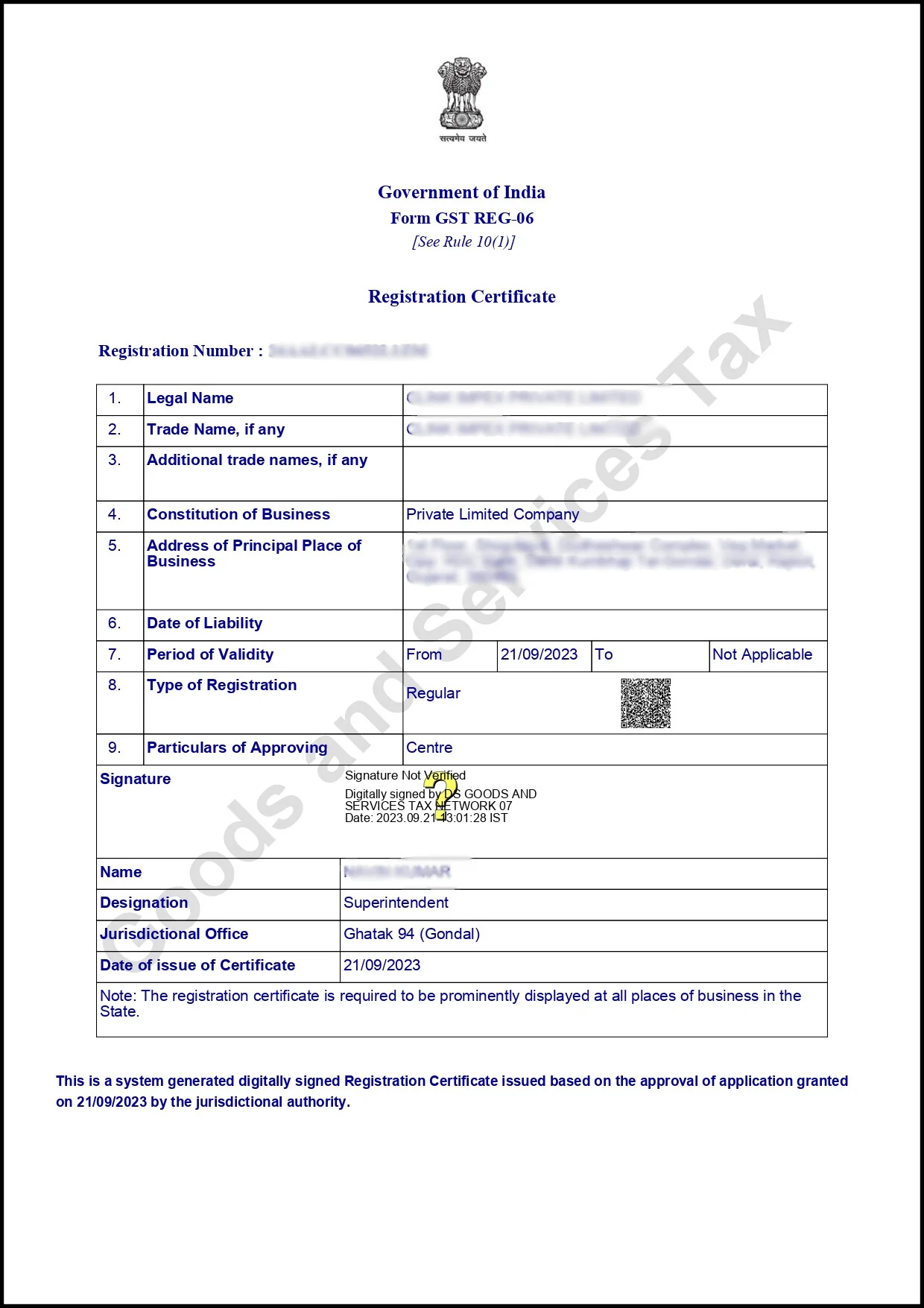

Businesses that cross certain turnover thresholds or fall under specific categories are required to register for GST as per the law. At Click To Professionals, we make the GST registration process smooth and hassle-free for you.

Goods and Services Tax (GST) is a comprehensive, indirect tax system that is multi-stage and destination-based. It applies to the supply of goods and services across India. Businesses with an annual turnover exceeding ₹40 lakhs for goods and ₹20 lakhs for services are required to register for GST and pay taxes on taxable supplies. However, businesses below this threshold may opt for voluntary registration to avail benefits such as Input Tax Credit (ITC). For businesses operating in special category states, the threshold limits are reduced to ₹20 lakhs for goods and ₹10 lakhs for services.

Registering for GST offers businesses a legal identity and ensures compliance with tax laws. It becomes mandatory once a business crosses the prescribed turnover limit. The registration process involves key steps such as identifying the correct type of GST registration, understanding GST regulations (often supported by online learning resources), and submitting an application through the official GST portal.

Each registered business is assigned a GSTIN (Goods and Services Tax Identification Number), commonly referred to as a GST number. This 15-digit unique identifier consists of:

The first two digits: State code

The next ten digits: PAN of the entity

The thirteenth digit: Entity code

The fourteenth digit: Currently unused (reserved for future use)

The fifteenth digit: A check code for validation

To complete the GST registration process online, applicants must submit essential documents such as PAN, Aadhaar card, bank account details, and proof of business incorporation.

Typically, the GST registration process is completed within 2 to 6 working days. At Click To Professionals, our experts ensure a seamless and efficient registration experience, guiding you through every step with clarity and support.

The primary types of GST registered in India are as follows:

This applies to selling goods or services within the limits of a state.

Goods and services sold in union territories such as Daman and Diu, Andaman and Nicobar Islands, Chandigarh, Lakshadweep, and Dadra and Nagar Haveli are subject to this tax. It is levied along with CGST.

GST is applied to all transactions involving the supply of goods and services within a state. Such intra-state transactions attract both Central GST (CGST) and State GST (SGST). This ensures uniform taxation and fair revenue sharing between the central and state governments.

Businesses should submit some essential documents for GST registration in India and ensure obedience to the Goods and Services Act.

Here are some essential GST registration documents:

GST registration is an essential step towards uniform taxation in India. It provides several benefits to registered companies. If your business is registered under the GST Act 2017, it can reap the following advantages:

Intentional Tax Evasion

If a business entity or an individual purposefully avoids paying the due taxes, the government charges 100% of the evaded tax amount as penalty.

For underpayments or non-payment

If a taxpayer avoids to pay the required tax or underpays mistakenly, the government charges 10% of the outstanding tax amount.

According to the GST Act 2017, the failure to get GST registration in India imposes a direct penalty charge that is applicable in cases where the registration is submitted after the deadline. Let’s have a look at a few consequences for not registering for GST:

Expert Guidance – Our team of GST professionals ensures accurate filing, timely compliance, and expert advice on complex GST matters.

Hassle-Free Process – From registration to return filing, we handle the entire process so you can focus on running your business.

Error-Free Filing – We follow a meticulous process to avoid penalties and ensure 100% compliance with GST laws.

Time & Cost Efficiency – Our streamlined approach saves you both time and money, ensuring maximum input tax credit benefits.

With our GST filing services, you gain peace of mind and the confidence to make informed decisions. Let us handle the numbers while you focus on achieving your goals.

The information provided by TAXFINCOM is for general guidance only and does not constitute financial, legal, or investment advice. Loan approvals and financial outcomes depend on third-party institutions and individual eligibility. We are not liable for any losses arising from decisions made based on our content or services. Please consult with a qualified professional before making financial decisions.

Copyright | All right Reserved | Taxfincom | Powered by Web Wonder Network