Whether your business is in its early stages or already established, registering it as a Private Limited Company builds trust among stakeholders and offers crucial legal benefits. It provides limited liability protection, safeguarding personal assets in case of financial or legal issues. However, the registration process involves multiple legal obligations that must be carefully followed.

At Taxfincom we offer affordable and hassle-free company registration services across India. Our experts manage all legal formalities in line with MCA (Ministry of Corporate Affairs) regulations, including:

We make the company registration process smooth, compliant, and cost-effective.

A Private Limited Company is a popular business structure for small to mid-sized enterprises in India. It limits the liability of its shareholders to their shareholdings, allows a maximum of 200 shareholders, and prohibits public trading of shares.

This structure is governed by the Companies Act, 2013 under the Ministry of Corporate Affairs (MCA). It requires a minimum of two directors and two shareholders, with at least one director being an Indian resident.

Private limited companies are preferred for their limited liability protection, separate legal identity, easy formation, and efficient management structure. It offers flexibility in ownership and is an ideal choice for entrepreneurs seeking credibility and legal protection for their business.

If you are a prospective business owner, consider the basic types of private limited companies while starting a company.

Here are the key types:

Members of these companies possess unlimited personal liability for the debts and responsibilities of their companies. However, these companies are still marked as a distinct legal body. Also, individual members cannot be accused.

As stated in the Memorandum of Association, each member is only responsible for the guarantee amount.

A private limited company is a separate legal entity that can own assets, enter contracts, and take legal action in its own name. Its shareholders and directors have limited liability, meaning creditors cannot claim personal assets for the company’s losses.

Shareholders' personal assets remain protected; they are only liable to the extent of their shareholding.

Private limited companies have better credibility, making it easier to attract investors and raise capital.

The company's existence is not affected by changes in ownership or the death of shareholders.

If you are wondering how to start a private limited company, you must know the registration process.

This guide describes the private limited company registration steps briefly:

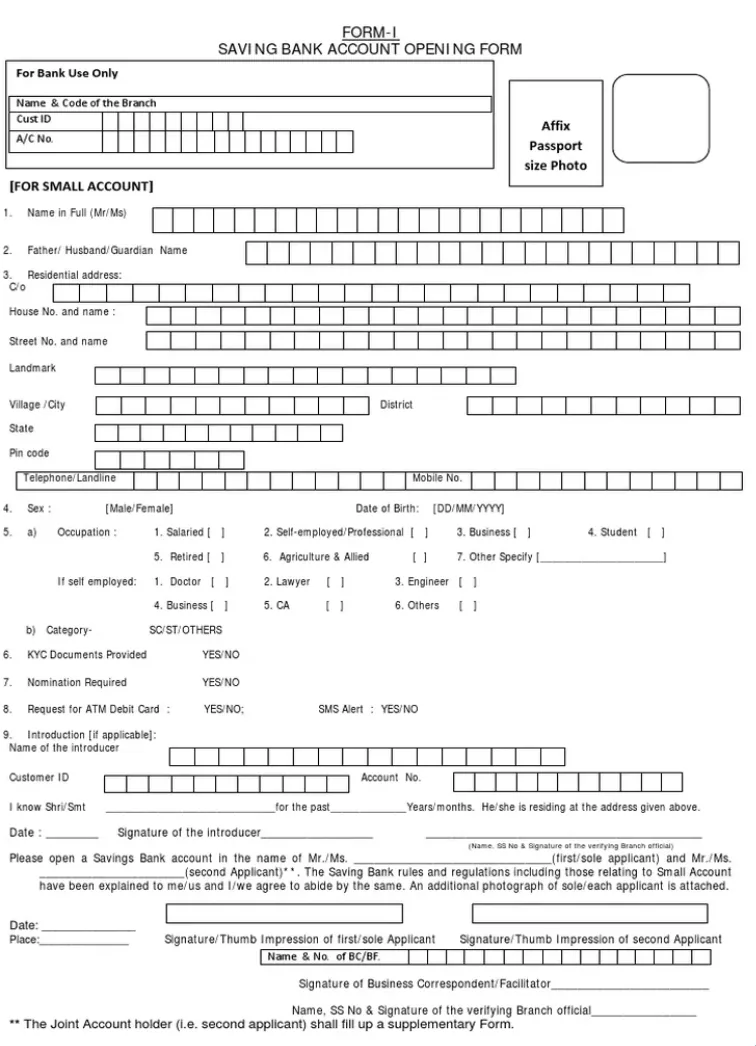

Proof of address and identity, such as passport, driving license, Adhar card, voter ID, PAN card, bank statements or utility bills

Proof of office address, such as sale deed/ownership deed or rental agreement/NOC from property owner

An affidavit on stamp paper that shows the declaration by all directors and subscribers confirming their wish to become shareholders of the company

Trademark registration certification or application

Copy of approval if the proposed company name consists of any expression or word that needs government approval

If Directors and Subscribers are Foreign Nationals

Passport as their proof of identity

Proof of address, such as government-issued identification with an authentic address, residence card, driving license, or bank statement

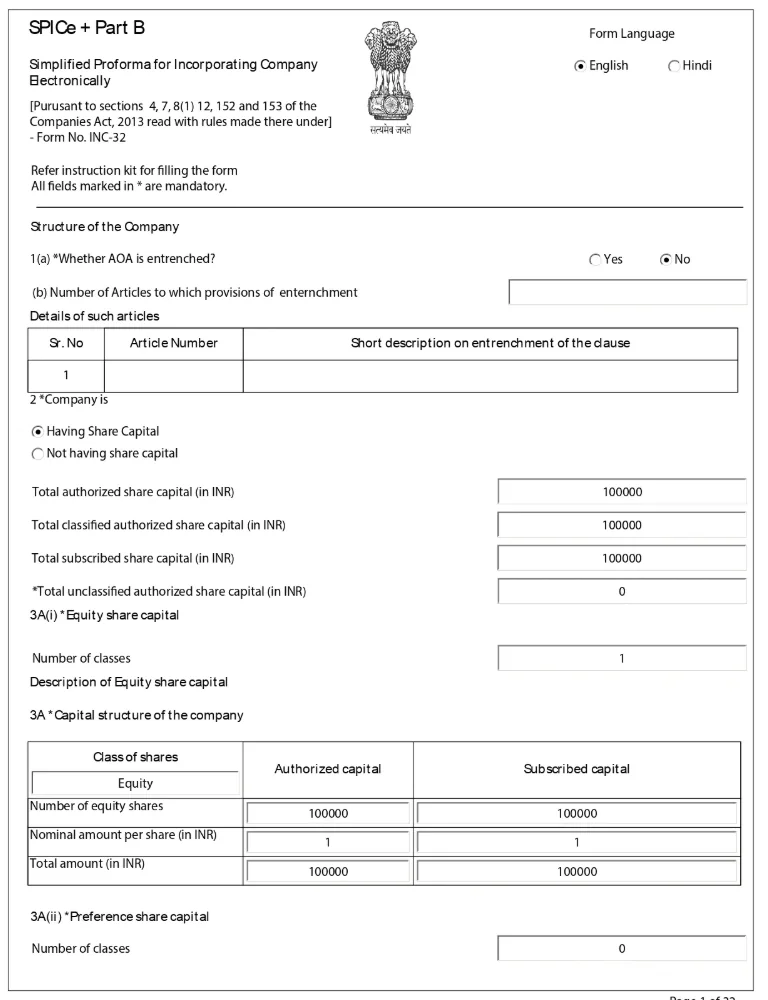

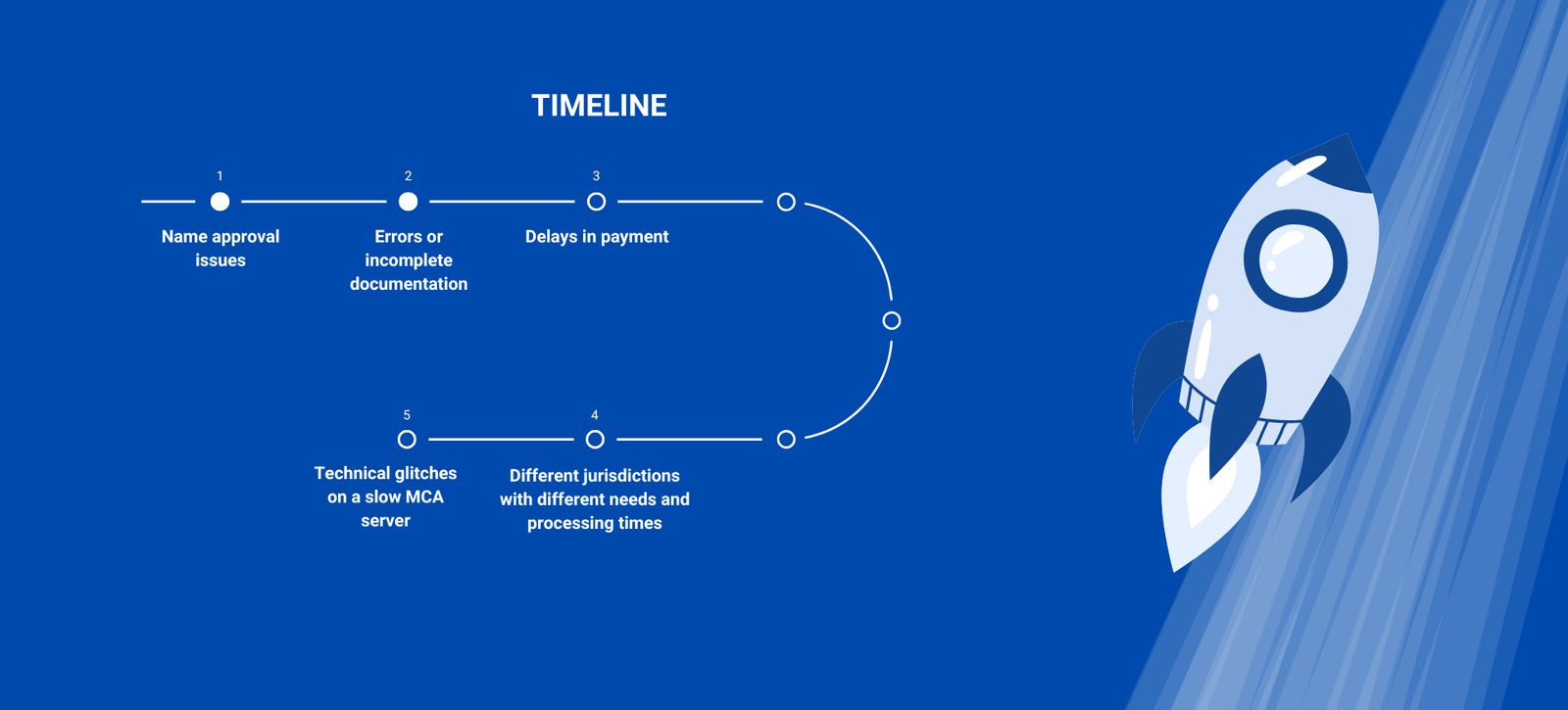

The registration process, including name, DIN approval, and incorporation, takes seven to ten working days. However, registering a PLC has become quick as you can attach all documents in one form with MCA. It’s a great step towards e-governance for businesses that seek to extend their operations. However, sometimes the registration process gets delayed because of some factors, including:

Common challenges during company registration include name approval issues, often due to similarity with existing names or trademark conflicts. Errors or incomplete documentation can lead to application rejections or delays. Delays in payment processing and technical glitches on the MCA portal, especially during peak times, can further slow down the process. Additionally, different jurisdictions may have varied requirements and processing timelines, affecting overall registration speed.

Must be unique, relevant, and compliant with Companies Act, 2013 and MCA rules.

Minimum 2 directors (1 must be an Indian resident), up to 200 shareholders allowed.

Permanent address to be submitted post-incorporation for official communication.

No minimum capital required, but generally ₹1,00,000 as paid-up capital is maintained.

At least 4 board meetings per year; minutes to be recorded within 15 days and confirmed within 30 days.

First auditor must be appointed within 30 days of company registration.

According to the MCA, you must meet a few private limited company registration requirements when registering a PLC.

Here is an outline of those requirements:

With our Company registration services, you gain peace of mind and the confidence to make informed decisions. Let us handle the numbers while you focus on achieving your goals.

The information provided by TAXFINCOM is for general guidance only and does not constitute financial, legal, or investment advice. Loan approvals and financial outcomes depend on third-party institutions and individual eligibility. We are not liable for any losses arising from decisions made based on our content or services. Please consult with a qualified professional before making financial decisions.

Copyright | All right Reserved | Taxfincom | Powered by Web Wonder Network